The Stack Reset: From Chaos to Clarity in Multifamily Real Estate

After years of rapid-fire tech adoption, multifamily operators are reckoning with the consequences: bloated stacks, overlapping tools, and brittle integrations. Now, the industry is entering a new era — one defined by restraint, replatforming, and a clear-eyed focus on what actually works.

This is the story of The Stack Reset: the deliberate move away from noise and novelty, and toward tech ecosystems that are leaner, smarter, and built to last.

This whitepaper is available as a printable PDF. Tap the button to download.

In 2020, everything in property management went digital overnight. Leasing agents, once the face of the community, went remote. Maintenance teams adapted to social distancing. Owners demanded new metrics, new tools, and faster decisions. The industry met the moment — but it did so in a rush.

Technology flooded in: virtual tour software, self-guided leasing, mobile maintenance apps, prospect communication tools. Much of it worked. Some of it didn’t. But very little of it was part of a unified strategy.

“We went from a tech desert to a tech downpour — and didn’t have a raincoat.”

Now, five years later, the landscape is cluttered. Many operators find themselves with dozens — or even hundreds — of tools layered into their portfolios. No one quite knows how they got there. And everyone’s wondering how to make sense of it all.

Much of the confusion stems from how these tools entered the organization. Marketing teams often purchased leasing or communication tools independently, eager to improve prospect engagement. Operations teams experimented with automation to handle mounting tasks. Owners frequently introduced vendors with ties to their other assets or investment portfolios. And IT departments — stretched thin — had little oversight or enforcement power.

The result wasn’t just a stack — it was a patchwork. Teams now find themselves navigating tools they didn’t select, supporting platforms they didn’t scope, and stitching together workflows they didn’t design.

As one executive put it, "No one owns the whole picture. Everyone owns a piece of the pain."

A Stack That Grew in the Shadows

Tech stack sprawl didn’t happen because operators were careless. It happened because everyone was trying to solve urgent problems in real time — and departments moved fast.

Marketing brought in leasing tools. Owners pushed their preferred vendors. On-site teams requested scheduling apps. Meanwhile, IT — already stretched — often had little say.

One operator revealed they had more than 140 vendors per property, many of them doing similar jobs in different regions.

“Most organizations don’t even know what they’re using anymore. There’s no inventory, no visibility, and no ownership.”

And integration, the promise that held it all together, often failed to deliver. While APIs were touted in sales decks, actual data flow was messy. Some integrations pulled in incomplete data. Others failed to sync at all.

One executive described their experience bluntly: "Our teams are spending their time checking whether the integrations worked — not actually using the systems."

| Who Bought What? | |

|---|---|

| Marketing | CRMs, leasing automation, prospect engagement |

| Operations | Task workflows, communication tools, maintenance platforms |

| Ownership | Asset-specific tools, BI systems |

| IT | Playing catch-up with oversight and integration |

| The result: A tech stack without a clear owner — and a lot of disconnected effort. | |

Three Paths to Clarity

The frustration has led to a broader movement — a deliberate reevaluation of the tech stack. Across the industry, operators are pursuing what many are calling The Stack Reset. But while the end goal is the same — fewer, better-integrated, more usable systems — the approaches differ.

1. Vendor Consolidation

For some, the reset means cutting aggressively. At RPM, Scott Pechersky, Chief Technology Officer, is reducing tools not just for cost, but for cohesion.

This approach favors fast wins — shrinking contracts, eliminating redundancy, and lightening the load on teams. But it comes with tradeoffs: in some cases, specialization is lost. Some tools "almost work" for everyone, but not quite anyone perfectly.

“We’re consolidating from more than 40 platforms to about 15. You get better training, better adoption, and a better handle on what’s working.”

2. Platform Re-Centering

Others are doubling down on their Property Management System (PMS)—not because it does everything well, but because it’s the one tool everyone touches.

“Core platforms like Yardi do a lot — property management, GL, job costing. But when we add something new, it has to integrate cleanly. That’s non-negotiable.”

For these teams, the goal is not perfection—it’s predictability. If a solution can live within or directly adjacent to the PMS, it gets a hearing. If not, it’s often a pass. Still, it’s worth noting: most existing PMS platforms suffer from deep architectural rigidity, caused by:

Scope creep across task management, communication, and operational modules

Bundling of unrelated functionality into core schemas

Static data models stretched to serve diverse use cases

This rigidity explains why some operators pursue a third path.

3. Rebuilding Internally

A third approach — used more selectively — is to build from within. These teams are not layering on tools; they’re building infrastructure. Internal platforms, APIs, and data layers that support both day-to-day operations and long-term flexibility.

This approach requires strong internal capabilities. But it’s appealing to operators who want control over iteration, data accuracy, and future extensibility.

"When you build something yourself," one executive explained, "you’re not just a user. You’re an architect. That changes how the stack evolves."

The Venture Capital Hangover

Some of the challenges now surfacing were seeded by the funding environment of the early 2020s. Venture-backed proptech startups were often advised to "find a wedge"—solve a narrow pain point, raise money, and then expand.

The problem? Many never expanded.

Their MVPs stayed minimal. The integrations never matured. The platforms never arrived. Operators bought in — hoping the roadmap would deliver — but found themselves stuck with thin tools that couldn’t scale.

"A lot of easy money came with bad advice," one executive said. "There were too many solutions solving one problem — and none solving the whole picture."

As funding dries up, some of those vendors are disappearing. Others are freezing development. And operators are left holding the bag — along with the maintenance contracts.

AI: A Capability Waiting for a Platform

Over the past two years, AI has emerged as the most talked-about layer in multifamily tech. And in most cases, the early results have been encouraging. Operators have piloted AI to automate document verification, predict renewals, score leads, and manage internal workflows. The tools work. The promise is real.

But something is off.

AI hasn’t taken hold the way many expected. What started as energy has turned into inertia. Many operators are left with disconnected pilots — valuable in isolation, but difficult to scale or expand.

“Everyone’s excited about what AI can do,” said one senior ops lead. “But what we’ve built so far is a shelf of one-offs.”

At the core of the issue is architecture. AI, unlike earlier software cycles, doesn’t succeed just by being clever — it succeeds when it’s embedded, flexible, and broadly connected. It needs access to data, clear event flows, and room to iterate. But most data is hidden behind walls of vendor systems and not accessible to operators.

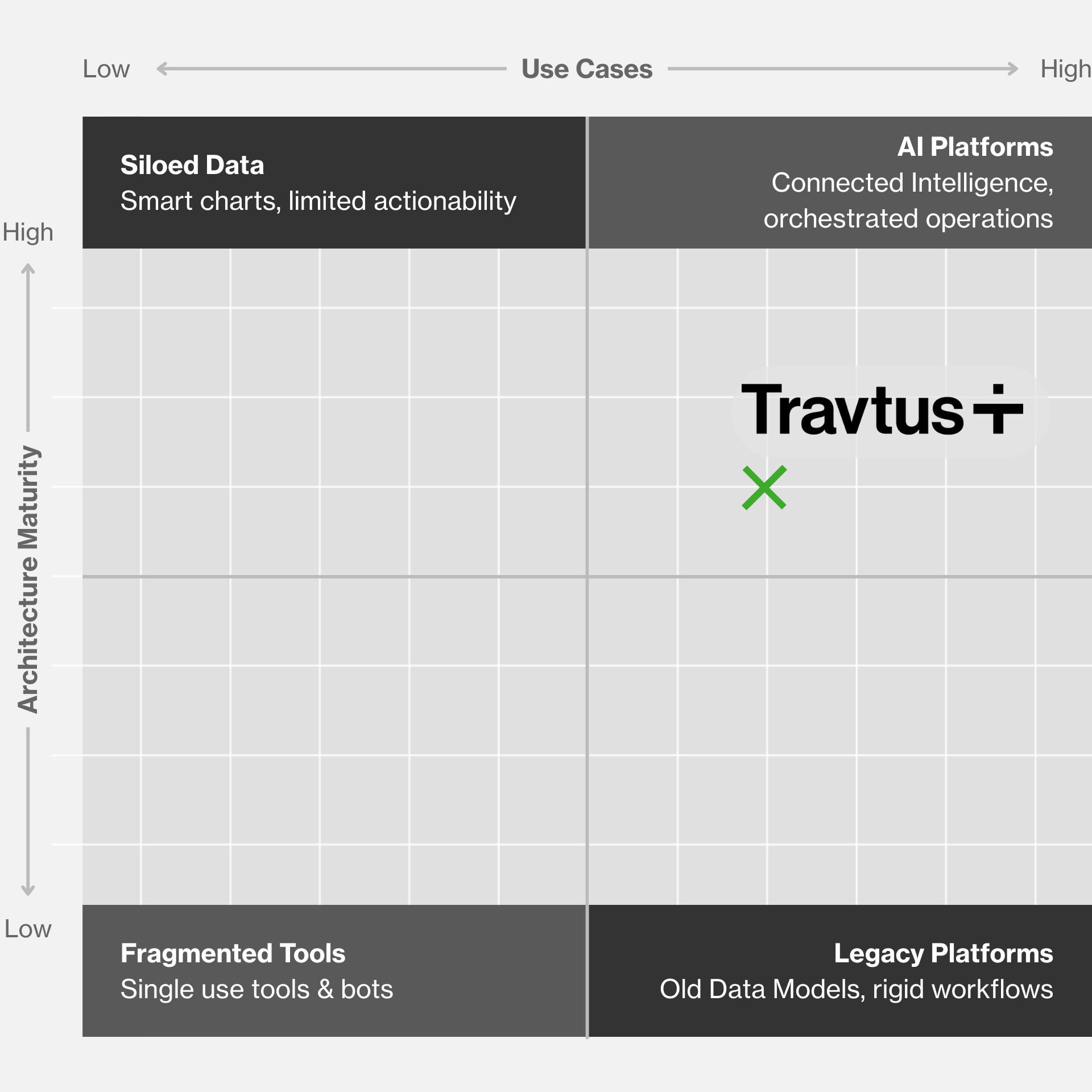

The challenge is that few operators have invested in a platform approach towards AI. And vendors that claim to offer one often struggle with the same limitations as everyone else: brittle integrations, poor data exchange, and inflexible schemas. So instead of transformation, most teams are getting repetition — trying to make smart tools work in systems that weren’t designed to be dynamic.

Still, the desire hasn’t gone away. In fact, it’s growing. Across the interviews, operators described AI less as a novelty and more as an expectation. Not just automation — but adaptation. Not just savings but scale.

The question now is: who will build the infrastructure to support it? And how long can the industry afford to wait? Because while the first wave of AI in multifamily has already happened, the second one — where it actually changes how work gets done — is still waiting for a place to land and the right sponsors.

What Would a Real AI Platform Look Like?

Most of the AI tools in multifamily today resemble apps — not platforms. They automate single tasks, run one model, or replace one decision — but they don’t scale across functions. They don’t learn from outcomes. And they rarely persist beyond the pilot.

A real AI platform is something else entirely.

An AI platform in multifamily would need to:

- Sit across operational, financial, and resident data

- Allow users to configure their own workflows, not just consume fixed outputs

- Enable teams to test, refine, and scale AI use cases — without ripping out core systems

- Treat AI not as a product, but as infrastructure

This is not something that can be patched together through MVPs. It requires deliberate investment, deep architectural vision, and a data strategy that puts operators — not just vendors — in control.

Rebuilding with Intention

This time, operators are asking harder questions:

What are we using?

Who owns it?

How do I get access to all the data?

There’s no single answer. But there is a new consensus: the stack must serve the work—not the other way around.

The Stack Reset isn’t about saying no to innovation. It’s about saying yes to stability, visibility, and scale. It’s about remembering that technology, at its best, disappears into the background—and lets teams focus on the residents, not the software.

After years of chaos, the industry isn’t chasing more tech. It’s chasing clarity.

“In three to five years, AI will help solve the integration problem. And when that happens, best-of-breed might come back. But until then, we’re betting on systems we know we can run.”

This whitepaper is available as a printable PDF. Tap the button to download.